Td canada trust easyweb login page , Canada is considered to be one of the wealthiest and most stable in the world economies, adds to his privileged economic status, its political stability, its policy includes immigration and by logic is also considered one of the largest donors in the world in international cooperation, has a per capita income highest in the world and operations of export and imports of high level, making it imperative to a system of banks in Canada, varied and functional.

Developed country is as we said a lot of banks in Canada of Canadian origin such as the Bank of Montreal, Canadian Imperial Bank of Commerce, National Bank of Canada. Royal Bank of Canada, Scotia Bank and Toronto Dominion Bank entities of great national coverage and operations worldwide with subsidiaries in all continents of the world.

The Canadian currency is the Canadian dollar, which has similar appearance to the American dollar, they are issued by the Royal House of the Canadian currency. But it is the Bank of Canada, which is located in the city of Ottawa, the issuer of the curren

Although this is one of the more recent central banks founded, as it was created in 1934, formerly the Bank of Montreal which served as Central Bank of Canada.

There are five banks that control about 90% of the operations of banking in Canada. These banks are the best for the Americans because the probability of failure is minimal, so your investment will be safe.

Canadian banks

The relationship with a bank in Canada is quite clear. Banks offer similar quality services such as transactions over the Internet, networks of automated teller machines (ABMs – ATMs in USA) to make life easier for customers.

Visit several banks and questions about their services or ask your acquaintances that they recommend you a bank. In the long run, it is possible you can not survive in Canada without a bank account. More importantly, is probably need one to receive your salary. You will have to open a bank account to rent or buy a home, pay for gas and electricity, acquire a telephone line and many other needs.

How safe are the Canadian banks?

The Corporation Canadian deposit insurance, in English The Canada Deposit Insurance Corporation (CDIC) is a federal Crown Corporation established in 1967 to provide deposit insurance and contribute to the stability of the Canadian financial system. In Canada, all banking institutions are members of the CDIC that guarantees deposits of savings of up to CAD$ 60,000 per depositor.

When choosing a bank

After you select which Bank to use, go to one of their offices and explain what type of account you are interested in open. You must be prepared to present two forms of identification issued by the Government (e.g.: Passport, driver’s license, Provincial health card, Social Security card) and proof of address (usually require a utilities Bill).

As a foreign resident, it is likely that they also want a reference from your employer University, educational institution or Bank who had relationship previously.

When choosing a Bank, you should consider what so far is the place where you live work, or what special package offers your empleador-universidad that can lower your cost of banking operations.

The largest Canadian banks are:

- Royal Bank of Canada (www.royalbank.com)

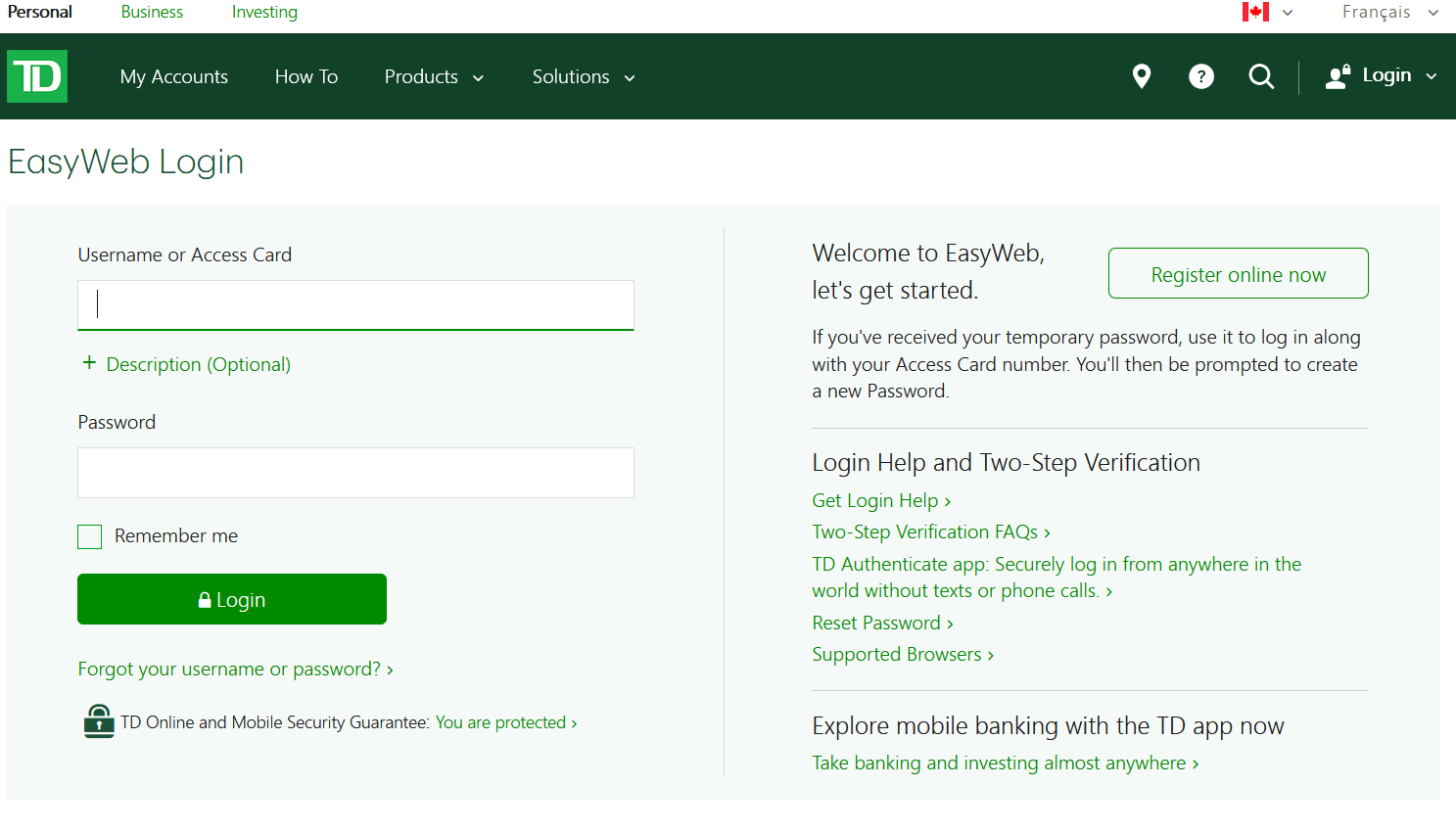

- TD Canada Trust (www.tdcanada.com)

- Canadian Imperial Bank of Commerce (www.cibc.com)

- Bank of Nova Scotia (www.scotiabank.com)

- Bank of Montreal (www.bmo.com)

All banks in this list have offices in most Canadian cities. There are also many regional banks, credit unions, and international banks such as HSBC, Citibank, ING Bank, UBS, etc.

Canadian banks serving citizens and immigrants

Banks in Canada are reliable and convenient, offering services to citizens and immigrants with confidence and security. There are many banks in Canada, both domestic and foreign. But there are 10 major banks in Canada that serve citizens and immigrants.

In addition, we have 29 domestic banks and 24 foreign banks in Canada. But there are 27 branches of full-service foreign banks.

List of Canada’s Top 10 Banks

- Toronto-Dominion Bank

- Royal Bank of Canada

- Bank of Nova Scotia

- Bank of Montreal

- CIBC

- Desjardins Group

- National Bank

- HSBC Bank

- Laurentian Bank of Canada

- Canadian Western Bank

#1: Toronto-Dominion Bank [TD]

Toronto-Dominion Bank is one of Canada’s top 10 banks serving citizens and immigrants.

This bank was established in 1955. It offers personal and commercial banking products and services in Canada.

Toronto: Dominion Bank has 1,154 branches with approximately 90,000 employees and serves 11 million customers. In 2020, bank revenues were C$36.4 billion, net income C$11.9 billion, and total assets: C$1.74 trillion.

#2: Royal Bank of Canada (RBC)

This is another of Canada’s top 10 banks serving citizens and immigrants. Its headquarters are located in Toronto and was founded in 1864.

Royal Bank of Canada provides services through five segments which are: personal and commercial banking, wealth management, insurance, investment and treasury services and capital markets.

The bank employs about 84,000 workers and serves 16 million customers. It has a total revenue of C$42.8 billion and a net income of C$11.4 billion in the year 2020. While a total asset of C$1.67 trillion in 2021.

#3: Bank of Nova Scotia

This is another of Canada’s top 10 banks. It handles total assets of approximately 1.16 trillion Canadian dollars in 2021. Its employees are 90,000 people and it serves 23 million customers in 55 countries.

In 2020, it generated a net income of 6.78 billion Canadian dollars. Revenue in the same year was 25.3 million Canadian dollars. This bank was established in 1832 in Halifax, Nova Scotia, while the headquarters are located in Toronto, Ontario.

#4: Bank of Montreal

Bank of Montreal is one of Canada’s top 10 banks. It serves both citizens and immigrants, and is established in the year 1817.

This bank currently employs more than 45,000 people and serves about 12 million customers. It provides retail banking, wealth management and investment banking products and services.

In 2020, it has a total revenue of 22.2 million Canadian dollars; Net income of 5.10 million Canadian dollars, while total assets of 973.2 million Canadian dollars in 2021. Its headquarters are located in Montreal, Quebec.

#5: CIBC

Canadian Imperial Bank of Commerce (CIBC) was founded on June 1, 1961 and is headquartered at Commerce Court, Toronto, Ontario.

The bank operates through three strategic business units which are Commercial and Retail Banking, Wealth Management and Capital Markets.

CIBC is one of Canada’s top 10 banks serving citizens and immigrants. It employs 43,890 people

and in 2020 its total revenue was CAD 16.2 billion and its net income was CAD 3.79 billion, while in 2021 it has a total assets of CAD 782.9 billion.

#6: Desjardins Group

Desjardins Group is a group of cooperative banks in Canada serving more than seven million members and customers in 30 countries.

It was established in 1900 and operates through four business segments which are: Wealth Management and Life; Health insurance; Property and casualty insurance; Personal services and commercial services.

In addition, this bank has more than 50,000 employees and is headquartered in Quebec and Ontario. In 2020, its total revenue was 11.4 million Canadian dollars and net income was 2.09 million Canadian dollars, while in 2021 its total assets were 377.0 million Canadian dollars.

#7: National Bank of Canada

National Bank of Canada was established in 1859 and is headquartered in Montreal, Quebec. It is another of Canada’s top 10 banks and offers

personal banking, commercial banking, insurance and payments solutions and services.

In addition, this bank has about 26,000 employees and serves 2.4 million customers through its 450 branches.

However, in the year 2020, its revenue was 7.08 billion Canadian dollars and its net income was 2.04 billion Canadian dollars, while its total assets were 343.6 billion Canadian dollars in 2021.

#8: HSBC Bank Canada

HSBC Bank of Canada is

headquartered in Vancouver and was incorporated in 1981. It operates through three business segments which are: Commercial Banking, Global Banking and Markets, and Retail Banking and Wealth Management.

In addition, it employs about 6,000 people and, in 2020, its total revenue was 1.70 million Canadian dollars; its net income was 308 million Canadian dollars, while its total assets were 115.0 million Canadian dollars in 2021

#9: Laurentian Bank of Canada

Laurentian Bank of Canada is another of Canada’s top 10 banks. It was founded in 1846 and is headquartered in Montreal. This bank serves individuals, small and medium-sized enterprises and independent advisors.

In addition, it offers investment products, including fixed-rate investments, index investments, mutual funds, systematic savings plans, retirement projection plans, registered plans and guaranteed investment certificates.

In addition, it operates more than 145 branches, with offices in British Columbia, Alberta, Nova Scotia, Newfoundland, Ontario and Quebec.

Finally, in 2020, its revenue was 854.7 million Canadian dollars and its net income was 114.0 million Canadian dollars, while its total assets were 45.2 billion Canadian dollars in 2021.

#10: Canadian Western Bank

Canadian Western Bank was founded in 1988 and is headquartered in Edmonton, Alberta. He specializes in mid-market commercial banking.

The bank also operates in Western Canada and offers mortgages, loans, personal accounts, investment products, business accounts, small business loans, insurance and credit card services to citizens and immigrants.

In addition, the bank employs about 2,000 people and operates 42 branches. In 2020, its revenue was 805.2 million Canadian dollars and its net income was 270.6 million Canadian dollars, while its total assets in 2021 were 35.3 XNUMX million Canadian dollars.

The best investment banks in Canada

Investment banks in Canada are dominated by domestic banks. They are considered the owners of the big five banks, but in total there are six. These investment banks are also among the top 10 banks in Canada that serve citizens and immigrants for investment purposes.

In addition, all investment banks are universal banks, while their main activity is retail and commercial banking, but they also have capital market arms.

Below is the list of the best investment banks in Canada

- Royal Bank of Canada [RBC]

- Canadian Imperial Trade Bank [CIBC]

- Bank of Montreal [BMO]

- Scotiabank

- Gravitas Stock Bank

- GreenBank Capital

- TD Securities Bank.

# 1. Royal Bank of Canada [RBC]

RBC is a capital market and a

Global investment bank. It provides M&A advisory services and equity capital market services to its clients.

In addition, the firm provides services in sectors such as CMT, Energy, Real Estate, Health, Mining and Metals, among others. Currently, it operates 70 offices worldwide.

# 2. Canadian Imperial Trade Bank [CIBC]

The Canadian Bank of Commerce and the Imperial Bank of Canada merged to form the Canadian Imperial Bank of Commerce, or CIBC, as it is more commonly known today.

Therefore, CIBC is one of Canada’s top 10 banks, which is tied to its continued and sustained investment going forward. They have modernized their banking platforms to improve the experience and convenience of their customers.

# 3. Bank of Montreal [BMO]

BMO is an investment bank that has been helping clients from all walks of life pursue opportunities, overcome challenges and achieve great things.

BMO is driven by a single purpose: to boldly grow business and life, and that means a strong focus on building, investing, being a champion of progress and a catalyst for change.

# 4. Scotiabank

With Scotiabank you can open a bank account before you arrive in Canada, with unlimited international money transfers free of charge.

For immigrants or newcomers to Canada, you can receive your first banking year with Scotiabank for free, with no monthly fees.

# 5. Gravitas Values

This is a full-service investment bank

that provides private placement and corporate restructuring services to its clients. In addition, it provides wealth management services.

# 6. GreenBank Captial

GBC is a small-cap investment bank focused on the Canadian market. He provides services such as advice on mergers and acquisitions, corporate financing, restructurings and others.

In addition, the firm provides its services in many sectors such as Energy, Technology and Financial Services.

# 7. Toronto Dominion Bank -TD Securities

TD Securities is a full-service investment bank. Services include advice on mergers and acquisitions, capital raising and restructuring. This bank offers its services in sectors such as CMT, Mining, Real Estate, Energy. It has 14 offices located in 10 countries.

Canada’s oldest bank

Bank of Montreal is Canada’s oldest bank and Canada’s first bank backed by over 200 years of proven and reliable experience.

In addition, Bank of Montreal was founded in 1817 and is one of the 5 largest banks in Canada. It provides various services such as wealth management, retail banking and investment banking products and services and is headquartered in Montreal, Quebec.

The largest banks in Canada.

Canada has many banks that serve both citizens and immigrants. Of many banks in Canada, there are five largest banks in Canada.

In other words, these five largest banks in Canada are called The Big Five Banks.

The big five banks are listed below.

- Royal Bank

- The Bank of Montreal

- Canadian Imperial Trade Bank

- The Bank of Nova Scotia

- Toronto-Dominion Bank.

Best Online Banks in Canada

Certain banks in Canada banks in Canada have gone beyond providing services to their customers in direct contact with online services. Online services have helped reduce the spread of COVID 19.

However, the following banks are the best online banks in Canada.

# 1. Equitable bank

Equitable Bank is one of the best online banks in Canada. It has no physical locations, however, customers have access to a well-qualified mobile app to access online banking. This makes banking flexible and convenient.

# 2. Tangerine bank

Tangerine is one of Canada’s leading digital banks. It is an online-only bank in Canada. It has some cafes, pop-up locations, and kiosks in Major Cities in Canada. But most of Tangerine Bank’s interactions with its customers are done through an online interface.