PNC Bank is one of the banks that currently offers a number of benefits and services, in order to meet the needs of all its customers. PNC Bank owns 9.000 ATMs and 2.600 branches in 19 states. Although the interests of your savings and credit accounts are not very competitive PNC offers a very satisfactory customer service.

PNC is located in 19 states of the United States such as: New York, New Jersey, Florida, Illinois and Pennsylvania. With PNC Bank you could open a Standard savings account with a minimum initial deposit.

Savings account: You can open a regular NCP savings account with $25 and if you keep a balance of 300 dollars you will not have to pay monthly fees. The interest of the account is 0.01%.

Credit card: With the PNC Core Visa Credit card You can save your interest during the first 15 billing cycles in purchases, then the interest can be between 12.24% to 22.24%.

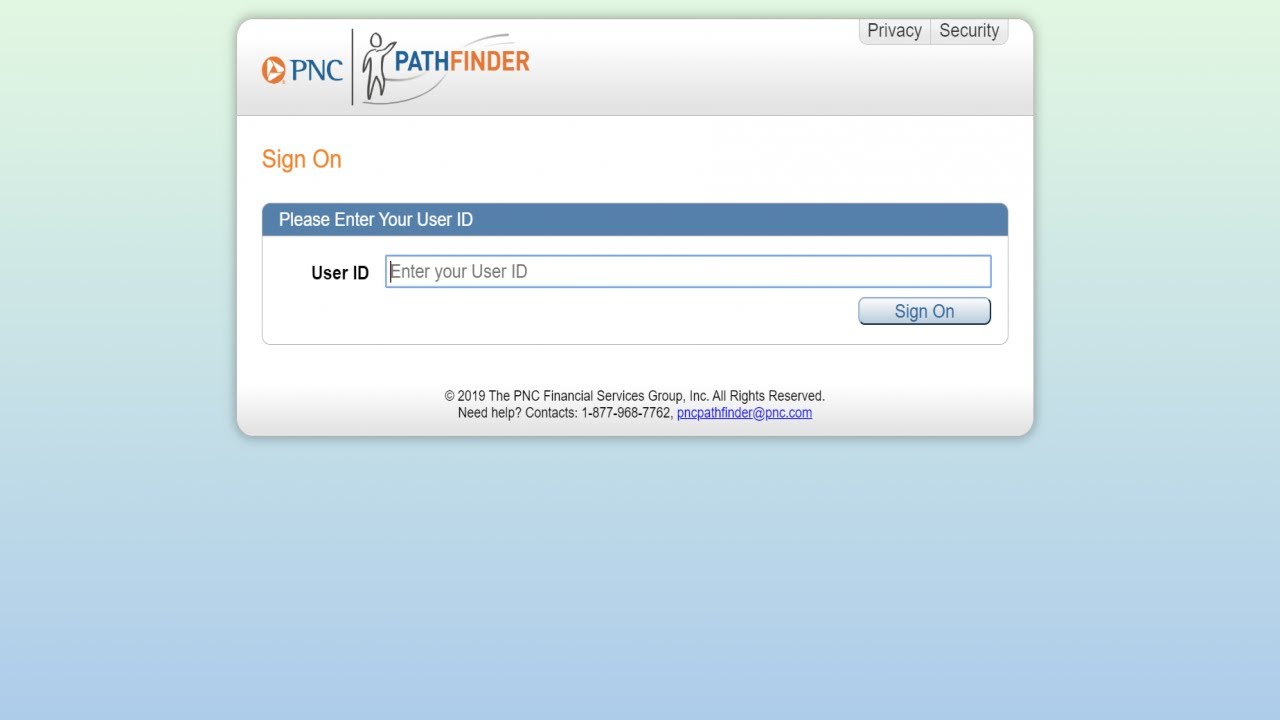

PNC portal pathfinder sign in

PNC Pathfinder is the portal for employees where you can manage the human resources that allows you to see the transactions and benefits Perzonalizados you can enter with the following steps:

- Open Safari or Chrome browser and open pncpathfinder.com

- Here you have to enter your User ID and need to click on a sign on

- It will take you to the dashboard of the website.

- Now You can access your PNC employee Portal

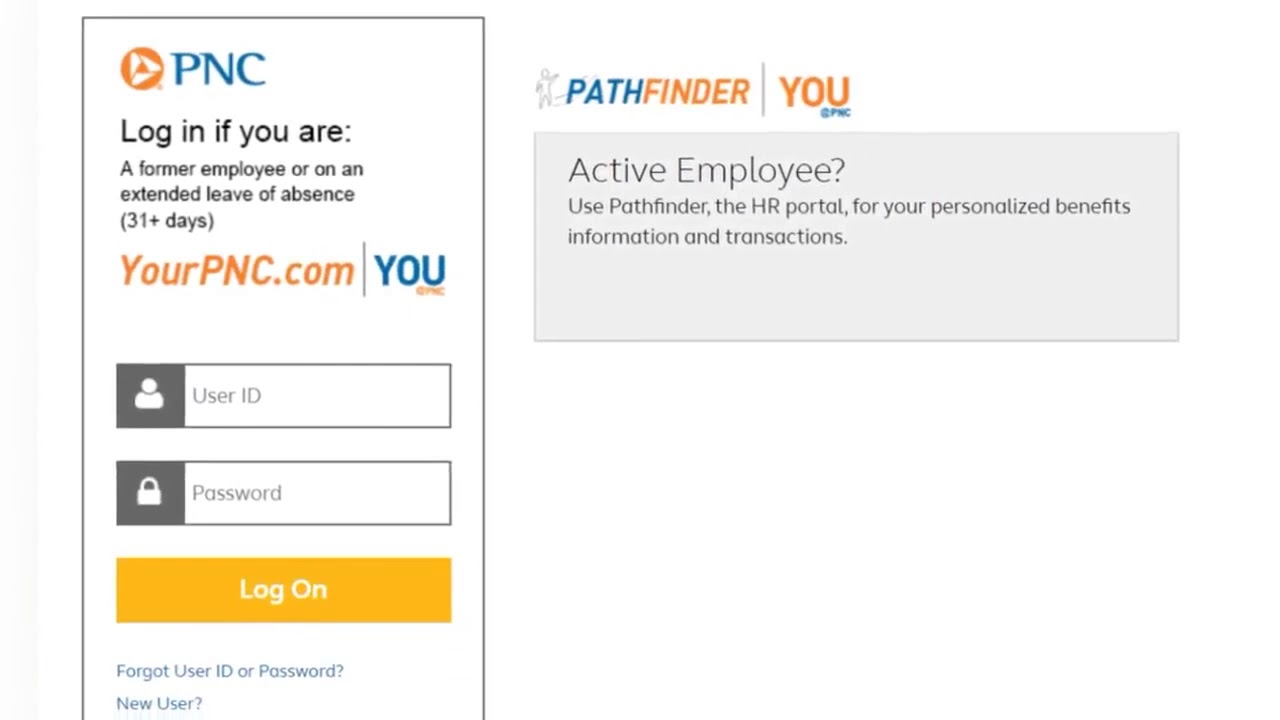

PNC Pathfinder former employee login

- Open Safari or Chrome browser and open https://leplb0930.portal.hewitt.com/web/pnc/login

- Here you have to enter your User ID and need to click on a sign on

- It will take you to the dashboard of the website.

- Now You can access your PNC employee Portal

What’s the number to call when locked out? Call us at 1-800-937-4445.

Best Banks For Savings Accounts

What you need to keep in mind is that a good savings account must have excellent customer service, cutting-edge technology and higher than average interest rates.

- Goldman Sachs Bank USA. This online bank has a strong savings option with a high rate of 2.05% APY and only a minimum of $1 to start earning interest incredible, right? It also does not require transaction fees and its online CDS have the best performance.

- American Express National Bank. It is an excellent choice for credit cards, but beyond that American Express offers an outstanding savings account with a rate of 1.90% APY. You should not cancel any monthly fees or minimum balances, and telephone assistance is available 24/7. It even allows you to link up to three accounts you have on other banks to make online transfers.

- Discover Bank. It has one of the highest interest rates for online savings accounts with a 1.90% APY, plus there are no monthly charges or a minimum amount to open an account.

- Alliant Credit Union. Alliant’s high-rate savings combine an excellent rate with high-quality digital tools like your mobile application. It also offers free access to more than 80.000 ATMs nationwide and 24/7 customer service by phone.

- Barclays. Here saving money is very simple, there are no minimums, maintenance fees and a maximum rate of 2.05% APY for your online savings account. You can transfer money to and from another bank and see the Barclays accounts on your website and mobile app,

- Ally Bank. This bank offers a stellar savings account with a competitive rate and no monthly charges or minimum deposit requirements. You earn 1.90% APY regardless of the balance.

- Chase. If you are looking for a traditional full-service bank, this is a solid choice. Specifically in the field of savings offer a registration bonus of $150 to new customers who maintain a balance of $10.000 for 90 days.

- Capital One 360. Your online savings account is free of charge, with no minimum balance requirement and a useful automatic saving tool. It offers a APY of 1.00%; Although not the highest, it is above the national average of 0.09%.

- Synchrony. Your savings account has a APY of 2.05% first line along with an optional card for free ATM withdrawals nationwide. The account has no minimum balance requirements, no monthly fees or fees if it exceeds the standard bank limit of six withdrawals per month.

They are definitely the best options. With this detailed list you will be able to select the bank that best suits your needs for you to save.