American express inquiry center , is an American financial institution, which among its various franchised credit card services. Their cards have an outstanding presence in the international tourism sector, so they are especially suitable for travellers.

American Express cards, except for Blue, provide a period in which the credit granted does not generate interest. Then, if you do not want to finance a purchase, you only have to cancel the amount of it, before the end of that term. This rule applies exclusively to purchases, so it excludes cash advances.

American Express has presence in more than 200 countries.

American express inquiry center

American Express offers exclusive benefits and international support to all its customers, which gives a plus to its services. It is distinguished, among other things, by its travel services to which it was dedicated since its foundation, so it is one of its greatest strengths and represents one of the fundamental pillars for which the public chooses them.

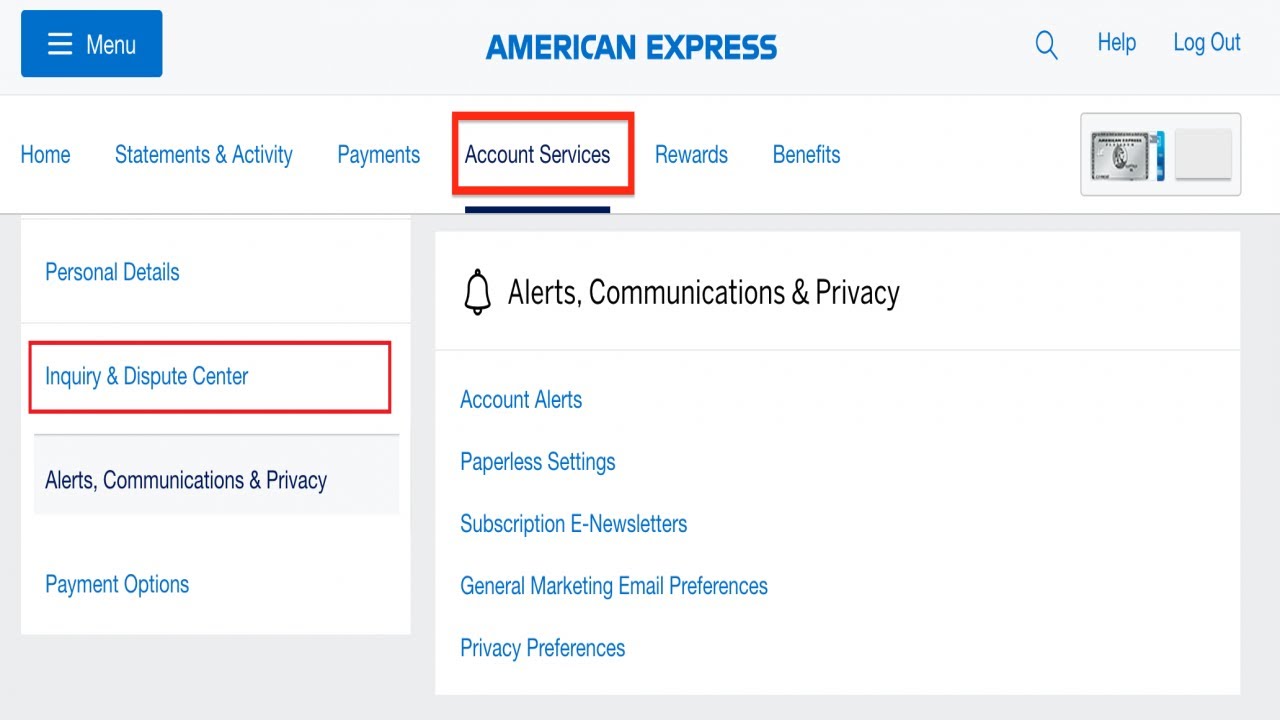

- Log into your American Express account.

- Select Account Services in the top menu bar. Inquiry and Dispute Center.

If you have any questions about your account, call American Express Customer Service 24 hours a day, 7 days a week. In Toronto: (905) 474-0870 North America: 1 800 668-2639 and International (please call collect): (905) 474-0870

Types of American Express credit cards

American Express offers different categories of credit cards, each oriented to a particular segment of the market.

- American Express Classic

This is the basic category of American Express and provides benefits that exceed the equivalents of the competition. It offers a great insurance plan, which includes repair or replacement for accidental damage, including international purchases. - American Express Blue

It is a variant of the previous category, aimed at young adults between the ages of 20 and 30. Offers discounts on airline ticket purchases as well as in bars, nightclubs and concert tickets. - American Express Gold

This credit card provides a larger amount of credit than the classic, as well as some extra benefits. Among these benefits is a package of travel insurance and discounts in restaurants and hotels. - American Express Black

It is a Premium type card that makes available a personal assistant 24 hours a day. It also offers great benefits for those who make international travel. - American Express Platinum

It is another American Express Premium type credit card designed for a high purchasing power segment. Designed for the international traveler, it offers a great miles accumulation program called the Benefit miles. - American Express The Platinum Card

This is the most prestigious of American Express credit cards and the one that offers greater profits. Its exclusive benefits make it one of the most prestigious credit cards worldwide. This card is only obtained at the invitation of American Express.

The Best American Express Credit Cards of 2019:

- The Platinum Card® from American Express: Best for high-end benefits

- American Express® Gold Card: Best for dining

- The Amex EveryDay® Preferred Credit Card from American Express: Best for everyday spending

- The Amex EveryDay® Credit Card from American Express: Best for everyday spending with no annual fee

- Marriott Bonvoy Brilliant™ American Express® Card: Best for high-end Marriott perks

- Hilton Honors Aspire Card from American Express: Best for high-end Hilton perks

- Hilton Honors Ascend Card from American Express: Best for occasional Hilton guests

- Gold Delta SkyMiles® Credit Card from American Express: Best for occasional Delta flyers

- Blue Cash Preferred® Card from American Express: Best for maximizing cash back

- Blue Cash Everyday® Card from American Express: Best for cash back with no annual fee

Compare American Express credit cards 2019

| Card | Bonus | Annual Fee |

| The Platinum Card from American Express | 60,000 Membership Rewards points after you spend $5,000 in first three months. Terms apply. | $550 |

| American Express Gold Card | 35,000 Membership Rewards points after you spend $2,000 in first three months. Terms apply. | $250 |

| The Amex EveryDay Preferred Credit Card from American Express | 15,000 Membership Rewards points after you spend $1,000 in first three months. Terms apply. | $95 |

| The Amex EveryDay Credit Card from American Express | 10,000 Membership Rewards points after you spend $1,000 in first three months. Terms apply. | $0 |

| Marriott Bonvoy Brilliant American Express Card | 75,000 bonus Marriott Bonvoy points after you use your new Card to make $3,000 in purchases within the first 3 months. Terms apply. | $450 |

| Hilton Honors Aspire Card from American Express | 150,000 Hilton Honors points after you spend $4,000 in first three months. Terms apply. | $450 |

| Hilton Honors Ascend Card from American Express | 125,000 Htilon Honors points after you spend $2,000 in first three months. Terms apply. | $95 |

| Gold Delta SkyMiles Credit Card from American Express | Earn 60,000 Bonus Miles after you use your new card to make $2,000 in purchases within your first 3 months and a $50 Statement Credit after you make a Delta purchase with your new card within your first 3 months. Offer ends 7/2/19. Terms apply. | $95 (waived first year) |

| Blue Cash Preferred Credit Card from American Express | $250 statement credit after you spend $1,000 in first three months. Terms apply. | $95 |

| Blue Cash Everyday® Card from American Express | $150 statement credit after you spend $1,000 in first three months. Terms apply. | $0 |

Advantages offered by American Express

The strong point of the Amex cards is the multitude of advantages that they offer you compared to the other credit cards. Here we detail some of them.

Membership rewards program amex

You can accumulate points for a certain amount spent. This is called Membership rewards with Payback and is a loyalty program. Then those points can be changed for rewards ranging from technology items, jewelry, accessories, housewares, travel, and much more. It all depends on the American Express card you have and how much you have used it.

Amex platinum travel insurance benefits

Amex cards offer plenty of insurance to cover all kinds of contingencies. The insurances included and the limit they cover varies depending on the card you choose.

- Travel Accident Insurance: covers the expenses of possible accidents during a trip as long as the tickets have been purchased with the Amex.

- Overbooking Insurance: In case of hiring a flight that does not have enough seats, the card covers the expenses of the first need for tickets purchased with the card.

- Travel Contingency Insurance: If you cancel your flight purchased with the Amex or are delayed for more than 4 hours you will be covered with urgent expenses such as food and drink, night in a hotel, etc. And as for luggage, if you do not have it available for more than 6 hours or directly lose it, you will also be compensated.

- Insurance to protect your purchases: everything you Buy has protection against claims for a period of 90 days. This means that you have insurance for all your purchases for 3 months just by buying it with the card.

- Insurance assistance: They offer insurance that covers medical expenses, surgical operations and medicines abroad.

VIP and Amex premium platinum

Most Amex cards also offer VIP and premium experiences, for example:

- VIP Rooms: Gold and Platinum cards offer tickets to the VIP rooms of the airports completely free of charge. Improvement of the loyalty programs: the RENFE and Meliá cards allow to increase the status of their respective loyalty cards according to the expense.

- Exclusive offers: Finally, they also offer exclusive offers for customers. And, although not official, they occasionally give away tickets to the theater or other activities depending on your spending.

- Free additional cards : All American Express cards offer the possibility to order more cards without increasing the fee except for the basic one, which only offers a discount. This allows other people to benefit from all these benefits completely free of charge.

Disadvantages

After talking about the advantages, it’s time to talk about the negative side of these cards. At the end of the day, nothing is perfect…

- They do not accept it everywhere: although in most establishments and online payment forms are accepted by Amazon, Paypal, flight companies, etc., there are many physical establishments that still do not accept them.

- It has a cost: all the insurance and benefits it offers are not a gift, but it forces you to pay an annual fee. The good thing is that the first year is free and if you are not convinced you can unsubscribe without any problem.

- It can encourage you to spend more: the fact that you give points for every euro you spend and then you can change them for prizes can incite you to spend more and this is not the idea that we want to promote. The best thing is to use it responsibly and do not get obsessed with the points you receive.